How to move to South Africa

Make the most of your money for the move

Guide on moving to South Africa

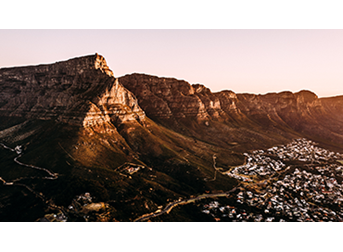

6 minute readStunning scenery, a warm climate and the widespread use of English are just some of the reasons why many Brits move to South Africa. With the favourable GBP to ZAR exchange rate, the pound goes a lot further, whether you’re moving for a new career or buying a house in South Africa.

But, as is the case when emigrating to any country, there are a set of steps you’ll need to take. We’ve put together this in-depth guide on how to make moving to South Africa as smooth and simple as possible.

How to become a resident in South Africa

The process of acquiring a permanent residence permit can take up to 18 months to complete, meaning that a lot of those who move to South Africa do so with a temporary residence permit at first.

A temporary residence permit allows those moving to South Africa the right to live and work in the country for up to three years, during which time they can apply for a permanent residence permit.

As a British expat, the following permits are available to you and can cater for a range of needs:

- Study permits – for students

- Business permits – for international businesses looking to establish a base in South Africa or invest in local businesses

- General work permits – for individuals seeking work in South Africa

- Critical Skills Work Visa – for individuals seeking work with skills and qualifications on the South African government’s critical list.

- Retirement permit – for individuals retiring to South Africa with a monthly income (property rentals, pension payments etc) of ZAR 37,000 or cash holdings of ZAR 1,776,000 as proof of funds.

Types of permanent residence permits in South Africa

South Africa has as many as seven different permanent residence permits, specifically designed to cater for a wide range of requirements. Depending on which visa you apply for and on a number of other variables, the process of getting a permanent residence permit can take up to 18 months.

As well as permits for those with relatives or partners/spouses in South Africa, the following permits can be applied for by those moving to South Africa.

- Business permit – subject to financial requirements, while 60% of your total staff must be citizens or permanent residents of South Africa

- Critical Skills Visa – for individuals with experience in one of the professions on the South African government’s critical list

- Retirement permit – subject to individual having a monthly income (property rentals, pension payments etc) of ZAR 37,000 or proof of guaranteed future earnings of ZAR 1,776,000

- Financially independent permit – for individuals with assets worth over ZAR 12,000,000

How to apply for a residence permit for South Africa

Whether you require a temporary or permanent permit or visa, you are able to apply either at a Visa Application Centre in South Africa or back in the UK at the High Commission of South Africa. It’s worth noting that whether you apply from abroad or in South Africa won’t affect the speed of your permanent residency permit application, however temporary permits are typically processed more quickly when the application is submitted in South Africa.

Dependent on the type of permit applied for, several forms of identification and documents will be required. Here are a few standard documents those applying for permanent residence in South Africa will need to provide:

- Passport

- Two passport photos

- Birth certificate

- Medical certificate (dating from within the last six months)

- Radiological certificate (dating from within the last six months)

- A completed police check (dating from within the last six months in every country you have lived in for over a year)

Setting up a South African bank account

If you move to South Africa from the UK, you’ll need to set up a South African bank account for your financial needs.

Fortunately, the process is relatively simple for emigrating Brits and can be done with a permanent visa or a temporary one.

You’ll need to provide:

- A temporary or permanent residence permit

- Your passport

- Proof of address in South Africa

What currency do they use in South Africa?

The currency used in South Africa is the rand (ZAR), and has been since 1961. It is also accepted as legal tender in Swaziland, Lesotho and Namibia, despite them having their own currencies. The rand is subdivided into 100 cents, and note denominations include R 10, R 20, R 50, R 100 and R 100.

If emigrating to South Africa from the UK, it pays to keep a close eye on the pound to rand rate, so you can monitor any movements in the rate and in the value of your intended payment. You can even set up a rate alert from your Moneycorp account. This way we’ll notify you via email or SMS when the GBP to ZAR rate reaches a set level of your choosing before you make a payment.

Moving pets to South Africa

Pets are allowed entry into South Africa from abroad, provided a set of rules and regulations are met by the owners.

All dogs and cats that enter the country must have an ISO 11784/11785 compliant microchip inserted. If your pet has a non-compliant microchip, you will need to bring the appropriate microchip scanner with you when you travel to South Africa.

You will also need to apply for a Veterinary Import Permit for your pet, which can be done with the Director of Animal Health. Once issued, an import permit is valid for six months.

Vaccinations for rabies and a number of other diseases will need to have been administered less than 30 days before your move to South Africa, however less than a year before the date.

Cats and dogs under the age of three months don’t require vaccinations to enter the country, however the mother of the animal must have been vaccinated more than 30 days prior and less than a year before the birth.

Foreign currency exchange for moving to South Africa

Emigrating to any new country requires making multiple payments to your new foreign bank account from your bank in Britain. Many high-street banks can incur fees of up to £30 for such transactions, which of course equates to hundreds of pounds when making multiple transfers to pay for a house in South Africa or transfer your pension overseas.

As foreign currency specialists, however, we are dedicated to saving you time and money on your international payments to South Africa. We can help you get the most out of your money, by offering low transfer fees, a competitive GBP to ZAR exchange rate and a dedicated service.

Open an account to start transferring today

Making the most of your international payments account

Tips on making the most for your money when you emigrate

Our News Hub has plenty of easy-to-read guidance on how to emigrate abroad