The Secret Economist on Q1 FX markets, and what next for Q2?

Make sure you sign up to The Secret Economist to receive the very latest guidance straight to your inbox

Share Story

It’s time for a worthwhile look back at what has gone before in the past 12 weeks in the major currency markets, as well as looking ahead to what might be to come in Q2 and beyond.

9 minute readThe UK pound – significant outperformance versus US dollar, euro and yen, thanks to better data, faster vaccine delivery

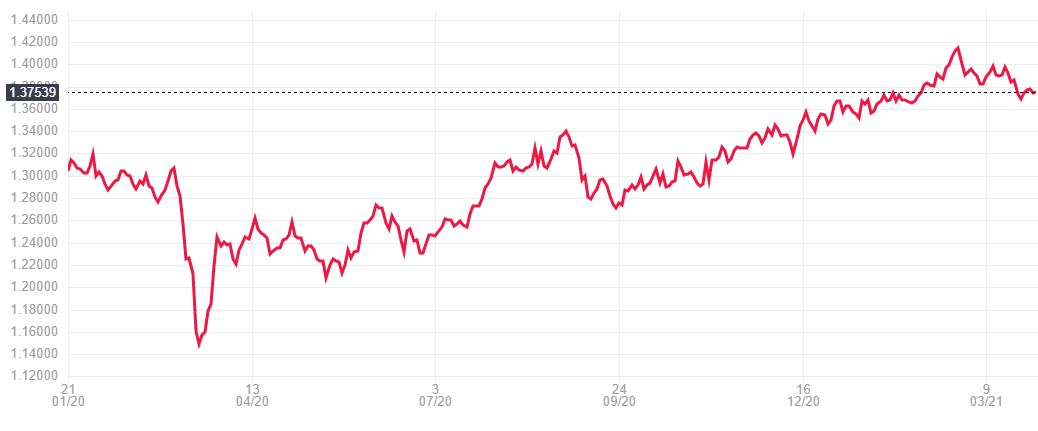

The past quarter has seen the pound perform strongly. Having closed out 2020 at the highs for the year against the US dollar, it spent January consolidating on previous gains before surging above $1.40 in late February. The pound was also strong against the euro, rallying from below €1.12 at the beginning of 2021 to above €1.17 in late Feb, before slipping back, and an almost 7% rally in the pound against the yen.

What caused the strength in the pound?

In part it has been a number of better than expected data and survey releases. The UK went back into lockdown at the beginning of 2021, and the fears that this would materially weaken economic performance have been largely unfounded. PMI data has shown strength returning to manufacturing, services and construction, as well as recoveries in consumer and business confidence surveys.

The big driver though has been the vaccine rollout, which has surpassed 26 million doses given, and vaccinated with at least one dose more than 90% of the vulnerable groups. The moves in vaccinations in the UK contrasts markedly with what’s happened in continental Europe, where they have only just passed vaccinating 10% of the population and are seeing far lower take-ups of the vaccinations offered.

With UK economic output having fallen more sharply than drops in output in Europe and the US, the UK was going to need to recover more quickly, and whilst it will be slow off the blocks, because of the Q1 lockdown, it is expected to gather speed quickly in the quarters to come.

So what about Q2 and beyond?

For the pound, I think there could be some problems ahead. We are already at peak optimism regarding the UK’s recovery, and equally other nations are expected to catch up in terms of vaccine programmes later into the year.

Furthermore, unlike prior to the last few weeks of 2020, and the beginning of this year, when the pound was undervalued, it does not appear to be undervalued now. That makes further gains more dependent on economic outperformance on a relative, country/economy basis, and versus expectations as well.

Sterling against the US dollar (GBP/USD) may well slide back in Q2, testing back towards the $1.35 region and possibly below there. I think there is more downside than upside risk for GBP/USD generally, and the risks are that if $1.35 doesn’t hold, then a push below $1.30 is on the cards.

For the pound against the euro (GBP/EUR), €1.18 is likely to prove a difficult level to break above, but if there is a move higher, then a more natural circuit breaker is just above €1.20, the multi-year high being €1.2082 post the 2019 UK general election (which was its highest level since 2016). I think a push back towards €1.13 more likely within the next 2 quarters, but thereafter the pound could reassert itself.

As for sterling/yen (GBP/JPY), which is higher than it has been since April 2018, we could see further upside for this pair, whether that’s down to weakness in the yen or strength in the sterling. Note that since the beginning of November 2020 the rise in GBP/JPY has been even more impressive, at over 11%. Surely though that makes additional gains more challenging, and a push back towards ¥145 more likely than any moves beyond ¥156.6, the 2018 high.

From an economic perspective, will Brexit be a drag on activity, or will the UK continue to sign trade agreements around the globe to support exports, investment and growth? Most of the deals signed so far have been holdover agreements, replicating what was in place as a member of the European Union. However, the UK has made overtures to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which could deepen trade relations with Asia and parts of North and South America, and has potential to be a game changer for trade deals with the US.

GBP/USD – From the minus column to plus column in 12 short months (Q1 2020 to present)

The euro – started strong but faded quickly as vaccine programme stutters

The euro against the US dollar (EUR/USD) has been an interesting battle over the course of Q1 2021. In the early part of 2021 EUR/USD hit its highest level ($1.2349) since Q2 2018, but it soon fell back (dropping to below $1.1850 at one stage in early March). The concerns over the new US administration’s plans for public spending have rapidly been superseded by issues over the European vaccination programme, with only a 10% of the population of the European Union vaccinated, and much larger numbers of the population refusing to take various vaccines thanks to poorly judged commentary from European leaders over efficacy and safety.

A return to ‘normal’ for society and the economy looks much further away versus the likes of the UK and US. Moreover, if vaccine scepticism continues to grow around the major economies of the European Union, the risk of more restrictions or lockdowns in the quarters to come will grow.

The rise in yields and slowing of risk appetite improvements has not helped the euro, either. Should the rise in yields persist, it is likely to be accompanied by risk appetite improvement, but whether or not that’s enough to override the rise in yields and turn EUR/USD in the euro’s favour remains questionable. It could be that the actions of the European Central Bank, who have recently stepped up the pace of asset purchases to check the rise in yields, may have a negative effect on the euro.

I’m not convinced of the upside for the euro, and think it will find trouble against other currencies as well. The risks are that, as the year unfolds, the euro fails to capitalise on its early gains, and falls back once again versus the US dollar. Any moves higher will likely run into trouble around the €1.2225/50 region, whereas lower will initially target sub-$1.15.

It remains to be seen whether the euro, which is already one of the worst performing G10 currencies versus the US dollar, will end secure its place at the bottom. If it does, it will likely be the result of poor political decision making.

EUR/USD – since the beginning of 2020

The US dollar – Biden pessimism done? Will yield curve reversal support a further USD bounce?

US President, Joe Biden, who some regard as a quiet man of politics, has been anything but quiet since taking office, and the noise he’s made has had a significant impact on financial markets and the US dollar.

It was well known prior to his inauguration that he wanted to spend big, and one of his first acts was to push for a massive, $1.9 trillion, fiscal stimulus package for the US economy, that would help households, businesses and the push for Covid-19 vaccinations, testing and treatment.

That had already prompted the US dollar to lose a lot of ground against other majors over the final month of 2020, and those losses continued in early 2021.

The interesting thing though was not Biden’s success in getting the stimulus package through the House and Senate, but the warning that moderate Democratic Senators issued to Biden after the bill had passed. They were of the opinion that the next stimulus, which Biden wants for the transformation of infrastructure and energy, would need to be a bi-partisan effort, rather than split down party lines like the fiscal relief bill.

The Federal Reserve did their best to disabuse markets of the notion that they would begin to taper asset purchases earlier, but the strength of some economic releases, including, belatedly, the non-farm payrolls data, offered additional support to the argument.

That checked the US dollar’s losses, and it turned against the euro and sterling late in the quarter, as the markets thought that the Biden administration would struggle to get the spending and tax plan through unamended.

The dollar has managed to check the gains made by other currencies, such as the Chinese yuan, and made significant gains against the Swiss franc (more than 4%) and Japanese yen (more than 5%) in Q1. However, against its nearest neighbour, Canada, the US dollar has performed most poorly over the course of the first quarter.

For the coming quarters, the questions are whether the markets are now well prepared for the fiscal news from the US, and whether it will be as bad as expected. Furthermore, the arguments will continue over whether the Fed will lift its foot from the accelerator pedal earlier than they have signalled. Watch for whether USD/CNY can push back towards CNY6.70, and whether the losses for the JPY and CHF persist or even extend. Potentially, we could see CHF0.95 and ¥115.